Phase One Findings

- 68% OF BANK MANAGERS KEEP TRACK OF THE NET WORTH OF THEIR LOYALTY/TRAVEL PROGRAM MEMBERS AND OTHER KEY METRICS FOR DETERMINING PROFITABILITY.

- 90% AGREE THAT THEIR PROGRAM RESULTS IN NEW-CUSTOMER ACQUISITION.

- 73% SAY OTHER BANKS IN THEIR MARKET HAVE A TRAVEL CLUB

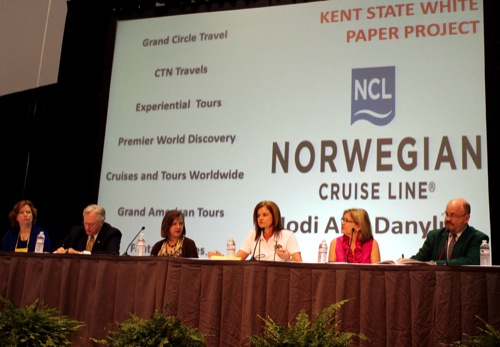

BankTravel research into the viability and long-term benefits of travel programs for banks was the topic of a panel discussion in Virginia Beach, Virginia. BankTravel Conference chairman Charlie Presley moderated a panel that included three bankers: Doug Robinson of Morton Community Bank in Morton, Illinois; Vickie Pannebecker of Eagle Bank in St. Louis; and Pam Shyne of Northway Bank in Berlin, New Hampshire. Also on the panel were Kristin Dowling, a spokesperson from Kent State University, which is doing the research, and Jodi Danyluk, a spokesperson for the underwriter of the research, Norwegian Cruise Line.

“Our job today is to discuss what we know so far and to have you help us design the next phase of this research,” said Presley. “And if you have not already, we ask that you get this document into the hands of your upper management.”

The first phase of the research includes these key findings:

68 percent of bank managers keep track of the net worth of their loyalty/travel program members and other key metrics for determining profitability.

90 percent of respondents agree that their program results in new-customer acquisition.

73 percent say other banks in their market have a travel club.

The next phase of the research may drill down from the bank directors to their members. Various attendees and panelists believed that they could make surveys available to their members or help BankTravel do that, provided that the data referred to the industry as a whole and not to a specific bank. Presley collected names of several banks that wanted to be involved in designing the next element of research.

“I’d be happy to send your surveys out to my members,” said Betty Snitchler of Sterling Federal Bank in Sterling, Illinois.

“I have a young manager who has no clue what we’re about,” said another attendee. “I have to explain to him that we may have $1 million in deposits traveling on one trip. This would help me tremendously.”

Shyne vouched for the value of the research thus far: “This is the first thing I gave my new manager,” she said.